vermont income tax brackets

Vermonts 2022 income tax ranges from 335 to 875. 2019 Income Tax Withholding Instructions Tables and Charts.

Location Matters Effective Tax Rates On Corporate Headquarters By State Freedom Day Freedom Tax Day

W-4VT Employees Withholding Allowance Certificate.

. Vermonts income tax brackets were last changed one year prior to 2003 for tax year 2002 and the tax rates have not been changed since at least 2001. Compare your take home after tax and estimate. What is the income tax rate in Vermont.

Vermont Tax Brackets for Tax Year 2020. The major types of local taxes collected in Vermont include income property and sales taxes. Vermont School District Codes.

In addition check out your federal tax. Vermont Income Taxes. Vermont based on relative income and earningsVermont state income taxes are listed below.

These income tax brackets and rates apply to Vermont taxable income earned January. We last updated Vermont Tax Rate Schedules in March 2022 from the Vermont Department of Taxes. This means that these brackets applied to all income earned in 2019 and the tax return that uses these tax rates was due in April 2020.

Income tax tables and other tax. 2017 VT Rate Schedules. PA-1 Special Power of Attorney.

Tax reductions and other aid for Vermonters Act 138 H510 Sec. 2021 Vermont Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator. Your 2021 Tax Bracket to See Whats Been Adjusted.

These income tax brackets and rates apply to Vermont taxable income earned January 1 2020. Any income over 204000 and 248350 for. The latest available tax rates are for.

Vermont has four tax brackets for the 2021 tax year which is a change from previous years when there were five brackets. 2017-2018 Income Tax Withholding Instructions Tables and. Vermont State Unemployment Insurance.

W-4VT Employees Withholding Allowance Certificate. This form is for income earned in tax year 2021 with tax returns due in April 2022We. PA-1 Special Power of Attorney.

Vermont tax forms are sourced from the Vermont income tax forms page and are updated on a yearly basis. These taxes are collected to provide essential state functions resources and programs to. More about the Vermont Tax Tables.

Your average tax rate is 1198 and your marginal tax rate is. Vermont School District Codes. Vermont also has a 600 percent to 85 percent corporate income tax rate.

We last updated Vermont Tax Tables in March 2022 from the Vermont Department of Taxes. Vermont School District Codes. IN-111 Vermont Income Tax Return.

Vermont Corporate Income Tax Brackets Tax Bracket gross taxable income Tax Rate 0 6000. Before the official 2022 Vermont income tax rates are released provisional 2022 tax rates are based on Vermonts 2021 income tax brackets. If you make 70000 a year living in the region of Vermont USA you will be taxed 12902.

Vermont has a graduated individual income tax with rates ranging from 335 percent to 875 percent. Vermont Income Tax Calculator 2021. In addition to the Vermont corporate income.

The 2022 rates range from 08 to 65 on the first. W-4VT Employees Withholding Allowance Certificate. Vermonts income tax brackets were last changed two.

Ad Compare Your 2022 Tax Bracket vs. Rates range from 335. As you can see your Vermont income is taxed at different rates within the given tax brackets.

PA-1 Special Power of Attorney. The Vermont Single filing status tax brackets are shown in the table below. 2017 VT Tax Tables.

The 2022 state personal income tax brackets are updated from the Vermont and Tax Foundation data. 12 of Act 138 changes the annual renewal fee paid by investment companies doing business in. The state income tax rate in Vermont is progressive and ranges from 335 to 875 while federal income tax rates range from 10 to 37 depending.

Vermont Income Tax Rate 2020 - 2021. IN-111 Vermont Income Tax Return. This form is for income earned in tax year 2021 with tax.

Vermont state income tax rate table for the 2020 - 2021 filing season has four income tax brackets with VT tax rates of 335 66. Income tax brackets are required state taxes in. As an employer in Vermont you have to pay unemployment insurance to the state.

The Vermont Married Filing Jointly filing status tax brackets are shown in the table below. This page has the latest Vermont brackets and tax rates plus a Vermont income tax calculator. Discover Helpful Information and Resources on Taxes From AARP.

2022 Vermont Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator. IN-111 Vermont Income Tax Return. Compare your take home after tax and estimate.

Tax Withholding For Pensions And Social Security Sensible Money

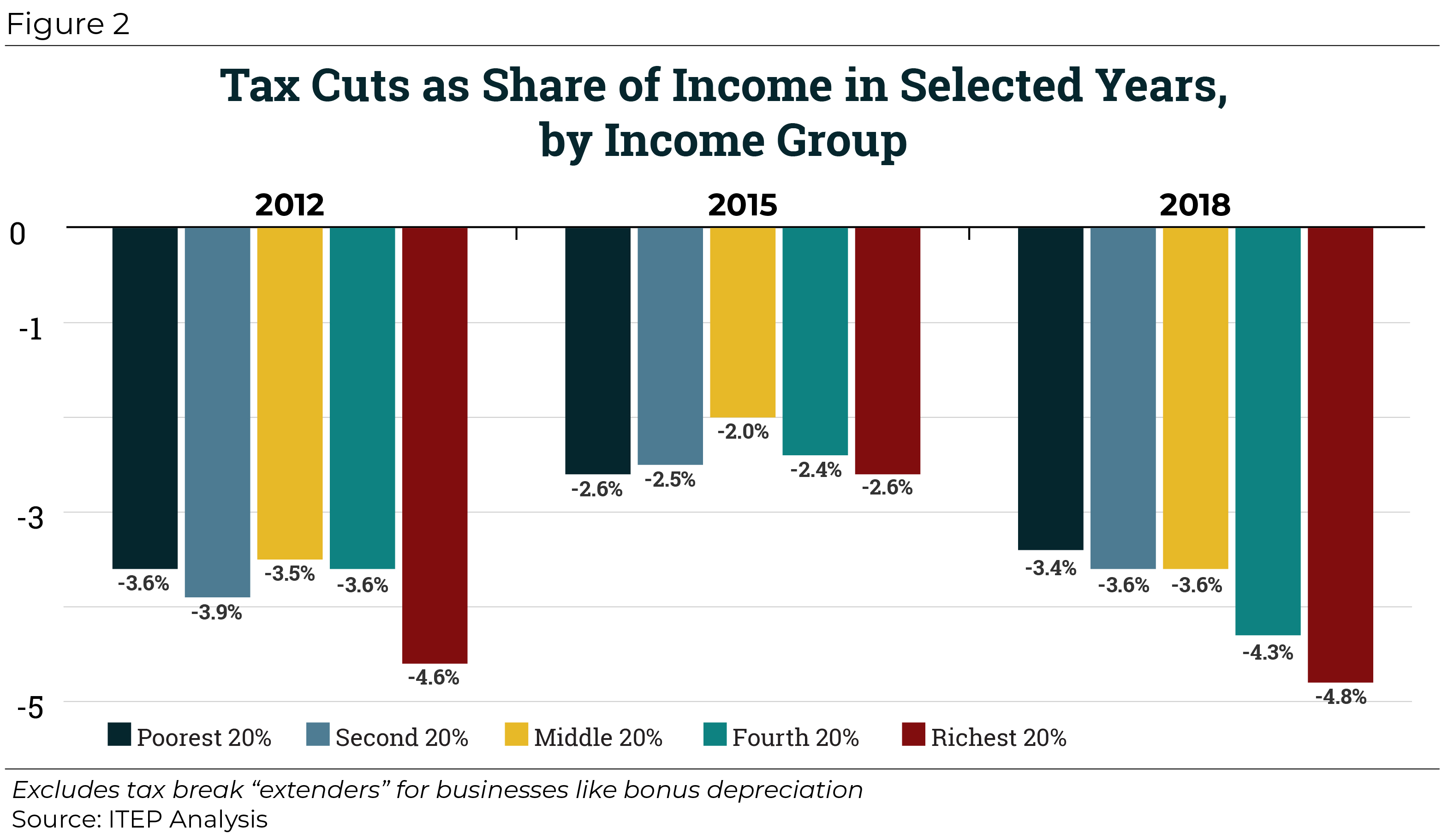

Federal Tax Cuts In The Bush Obama And Trump Years Itep

10 Best States For Taxes And The 10 Worst

Maine S Tax Burden Is One Of The Highest New Study Says Mainebiz Biz

Map State Sales Taxes And Clothing Exemptions Trip Planning Sales Tax Map

States With The Highest And Lowest Property Taxes Property Tax Tax States

Vermont Corporate Income Tax Rate 12th Highest Vermont Business Magazine

Income Taxes The Tcja And Taxpayer Migration

Analysis Vermont Has The Capacity To Avoid 2016 Budget Cuts Vermont Business Magazine

Complete Website Package Family Tree Family Genealogy Genealogy Tree

Vermont Tax Forms And Instructions For 2021 Form In 111

Buying Cheaper Than Renting But Some Mortgages Make It A Closer Call Trulia S Blog Rent Vs Buy Home Buying Home Ownership

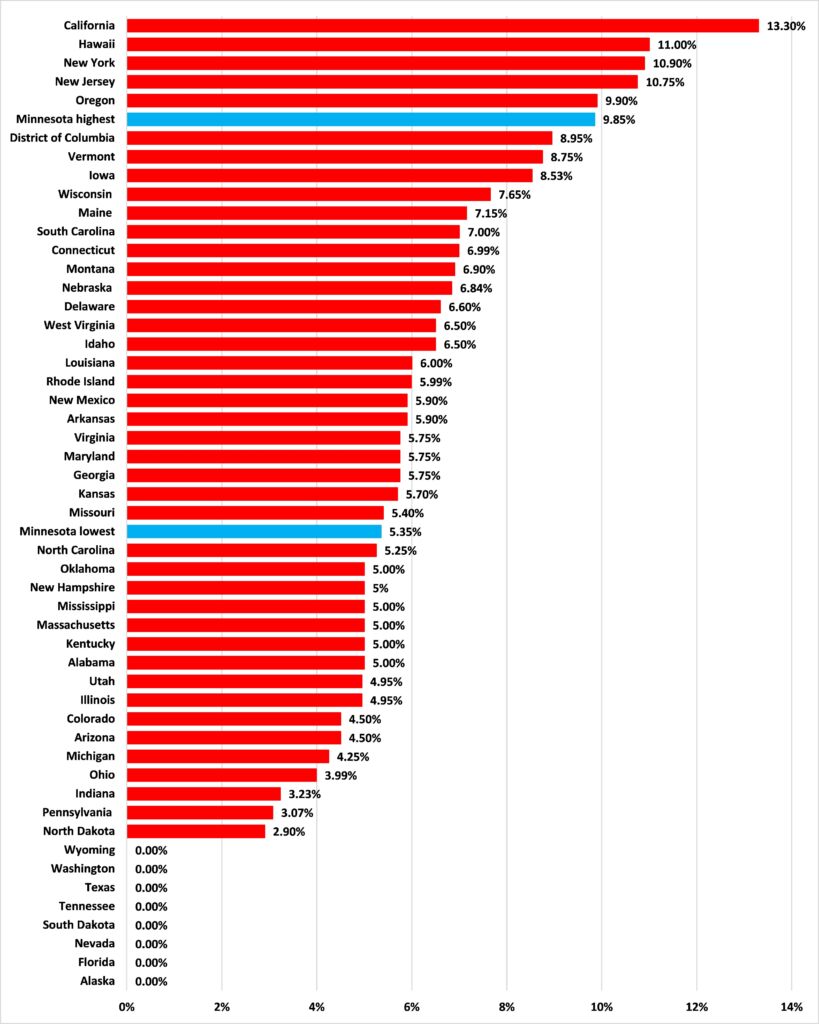

The Surplus Minnesota Has Some Of The Highest Tax Rates In The United States American Experiment

Tax Withholding For Pensions And Social Security Sensible Money

The Best And Worst U S States For Retirement Best Places To Retire Retirement Retirement Advice

The 10 Best States For Retirees When It Comes To Taxes Retirement Retirement Locations Retirement Advice